Generation Insurance Software Limited

Summary of

System Features

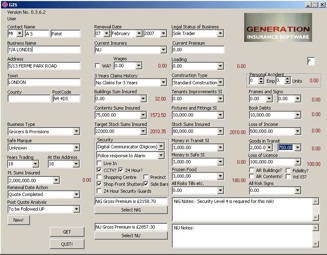

Generation’s Software is a comprehensive ‘Underwriting System’ that is designed to provide brokers with the ability to transact package insurance business in a new, flexible and efficient way that frees up their resources to build high quality business.

The system works from a simple front-end menu that takes the user to the appropriate underwriting screen.

The system enables the user to calculate insurance premiums ‘on screen’. At the front end of the system is a highly sophisticated quotation engine, which cannot be broken.

Because of the high level of programme security in this respect, and because the underwriting data is purely derived from the Insurer, prices and underwriting terms derived from quotes are correct according to the Insurers guide. The acceptance criteria of each individual risk are tight. The structure is designed to be either No Quote or Quote. No grey areas.

If the Software accepts the risk, it accordingly provides implicit authority from the Insurer, through Generation, to bind cover on that risk immediately and without any reference to a third party, Generation or the Insurer.

There are no referrals. The business is the business the Insurer wants to write at the price it wishes to charge.

Once a quotation has been accepted the system will hold the input data in a dedicated file and from there produce all of the documents needed to confirm and administer the risk.

It will automatically generate a pre-filled quotation letter and a fully completed attaching proposal form/Statement of Fact. If cover should be required by the client, it will produce a fully completed Insurance Schedule and EL Certificate.

Retail • Offices • Salons • Surgeries • Restaurants • Public Houses • Residential Lets • Commercial Lets • Tenants Contents